Events

The Disruption of the Global Economy Caused by Coronavirus

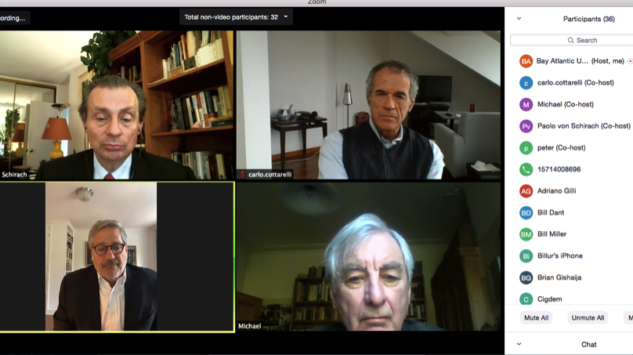

On April 20, 2020 the Global Policy Institute, GPI and Bay Atlantic University, BAU, held an international on line panel discussion titled “Will Globalization Survive the Coronavirus Epidemic?” in order to hear from renowned international experts about the reorganization of global economic activities after the coronavirus pandemic, with special focus on the US, Latin America, Great Britain and Continental Europe.

Watch the Full video of the event here

Panelists:

Professor Carlo Cottarelli, Director, Observatory on the Italian Public Accounts (CPI) of the Catholic University of Milan

Peter Schechter, Founder and Co-host, Altamar, a Global Affairs Podcast, Washington, DC, US and Latin America specialist

Michael Binyon, Senior Foreign Affairs Writer, The Times, London

Moderator:

Paolo von Schirach, GPI President, and Chair of Political Science and International Relations at Bay Atlantic University

Professor Cottarelli provided a clear account of Italy’s deteriorated fiscal predicament on account of the impact of coronavirus on the economy, and the need to support companies and individuals with emergency funding. At this time the situation is still manageable; but much depends on future support to Italy and other Southern EU members coming from the European Central Bank, ECB. Binyon pointed out that not much progress can be expected on the Brexit process since both the UK and the EU are absorbed by this health emergency. Likewise, not much light on viable growth strategies for a future non-EU Great Britain, given the global uncertainties regarding trade and investments.

Peter Schechter noted that, notwithstanding a massive $ 2.2 trillion stimulus package, the US lacks the necessary political cohesion linking the Federal Government in Washington and State Governments to ensure a smooth handling of this gigantic crisis. He also pointed out that some Latin American countries may end benefiting from the reconfiguration of global supply chains caused mostly by US companies relying less on China in the future. Cottarelli added that the stress on the Eurozone at some point may prove to be too strong, and therefore some weak countries may be forced to exit the common currency.

Binyon noted that this crisis has brought the British people together. Whereas last year there was talk of another Scottish independence referendum or of Northern Ireland leaving the UK, now there is a stronger feeling of national solidarity. He also noted that Russia is not playing a constructive role in this crisis, spreading false information aimed at creating divisions. Schechter pointed out that, should the coronavirus epidemic really spread to Central and South America, most countries lack the basic infrastructure to properly deal with it. Several questions from the audience dealt with the impact of this unprecedented crisis on fragile developing countries. Cottarelli noted that the IMF and the World Bank will be called upon to play a major role in an all efforts aimed at stabilizing weak economies.