Events

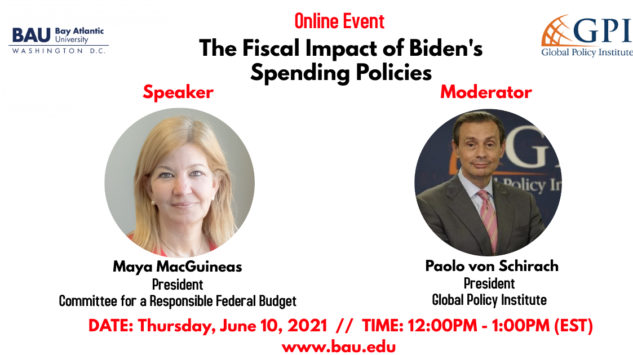

The Fiscal Impact of Biden’s Spending Policies

On June 10th, 2021 Global Policy Institute and Bay Atlantic University held a joint online event to discuss The Fiscal Impact of Biden’s Spending Policies with the President of the Committee for a Responsible Federal Budget, Maya MacGuineas.

Event Summary

Nowadays, the classical (and for the most part bipartisan) fiscal policy guidelines centered on moderate or even frugal public spending and the need (or at least the goal) to balance the US Federal Budget no longer apply. Significantly larger US public expenditures not matched by increased revenue are destined to grow, year after year, given the rising costs of key entitlement programs designed in a different era, with different demographics. Hence larger deficits contributing each year to a larger and larger US national debt, now as large as the debt incurred decades ago to finance the enormous WWII military effort.

At the beginning of 2021, spurred by the imperative of fighting the negative economic impact of the Covid pandemic, while also pursuing a very ambitious and costly agenda focused on beefed up programs on green energy, infrastructure and social justice, the Biden administration announced massive new federal spending plans, only partially offset by some proposed tax increases. While many disagree with the merit of specific policy goals, very few point out how trillions of dollars of new spending not matched by new taxes will contribute to significantly larger budget deficits, and ultimately a massive addition to an already very large US national debt. In fact, some economists now claim that massive federal deficits financed mostly via borrowing is alright. Increased deficits and debt do not matter that much. If so, was the old fiscal orthodoxy completely misguided? Or are we entering uncharted fiscal policy territory without the benefit of a good compass?

Maya MacGuineas pointed out at the outset that, yes, the US enjoys the unique advantage of borrowing in its own currency which is also the world’s reserve currency. At this time, no one doubts the ability of the US Government to meet its current financial obligations. As inflation and interest rates stay low, the additional fiscal strain caused by massive borrowing (to be added to already high levels reached prior to the Covid pandemic) is manageable. However, any changes in the sentiment of foreign buyers of US securities, coupled with resurgent inflation, or any financial crisis, may drastically alter this benign scenario. Which is to say, MacGuineas pointed out, that there are serious risks associated with increased borrowing.

Looking at the overall US fiscal picture, she said that most Americans do not realize that the bulk of federal spending is in the large and now underfunded entitlement programs (Social security, Medicare and Medicaid) that benefit mostly retirees and low income Americans.

Cutting other components of discretionary spending, including the very large US defense budget, would not alter the picture much. However, in the last several years, MacGuineas noted, there have been no serious efforts aimed at reforming entitlement programs (except for the “Debt Commission” that issued its Report at the end of 2010) so that they would become once again solid and solvent.

She noted that prior to the economic crisis caused by the forced closing down of so many activities on account of the Covid pandemic, the US government had already added massive amounts of new debt because of new spending that was matched by tax cuts, rather than tax increases.

MacGuineas pointed out that some of the new spending announced by the Biden administration is justified because of the need to support low income Americans hit hard by job losses during the Covid pandemic, while also investing in our future by funding green energy and infrastructure spending.

That said, she indicated that this level of spending proposed by the Biden administration is just too high, while the proposed tax increases will pay for only a small portion of these new outlays. She emphasized that additional spending is not the issue. The issue is spending financed mostly via additional borrowing, as opposed to increased tax revenue.

Right now, the US economy seems to be unaffected by growing federal deficits and a larger and larger national debt. Still, this trend creates fragilities and vulnerabilities that will make it much more difficult to deal with the impact of any potential future crisis. Indeed, just a 1% interest rate increase would double the amount of money that the federal budget has to set aside each year just to pay interest on existing debt obligations. More money devoted to debt service, means less money available to fund government programs.

In closing, MacGuineas expressed the hope that sensible centrists in both parties will ultimately realize that this trend of higher spending based on more borrowing is extremely dangerous and therefore will decide to rethink the federal budget so that we can go back on a path leading to fiscal stability.

Full Video:

Speaker bio

Maya MacGuineas, President, Committee for a Responsible Federal Budget

Maya MacGuineas is president of the bipartisan Committee for a Responsible Federal Budget. Prior to working for the Committee, she worked at New America Foundation, at Brookings, and on Wall Street. MacGuineas also was Senator John McCain’s Social Security advisor during his 2000 campaign. She has spent the past two decades working in the public policy arena with extensive experience in economics, finance, and fiscal policy, and her specific areas of expertise include the budget, entitlements, and tax policy. She works closely with many leading lawmakers on both sides of the aisle, has been published broadly in numerous leading outlets, and is a frequent commentator in the media. MacGuineas received her B.A. in economics and psychology at Northwestern University, and her M.P.P. from Harvard’s John F. Kennedy School of Government.

Moderator

Paolo von Schirach, President Global Policy Institute and Chair Political Science and International Relations, Bay Atlantic University