Issue Briefs

A Currency Board System would strengthen Turkey’s economy

Billur Guner Cohen

April 27, 2018

Since the 1980s financial crises, developing countries have struggled with implementing effective exchange rate regimes. As a developing country, Turkey too has suffered from economic and financial crises since the transformation and liberalization of its economy in the 1980s. And deciding the optimum exchange rate system for the Turkish economy remains one of its most controversial problems.

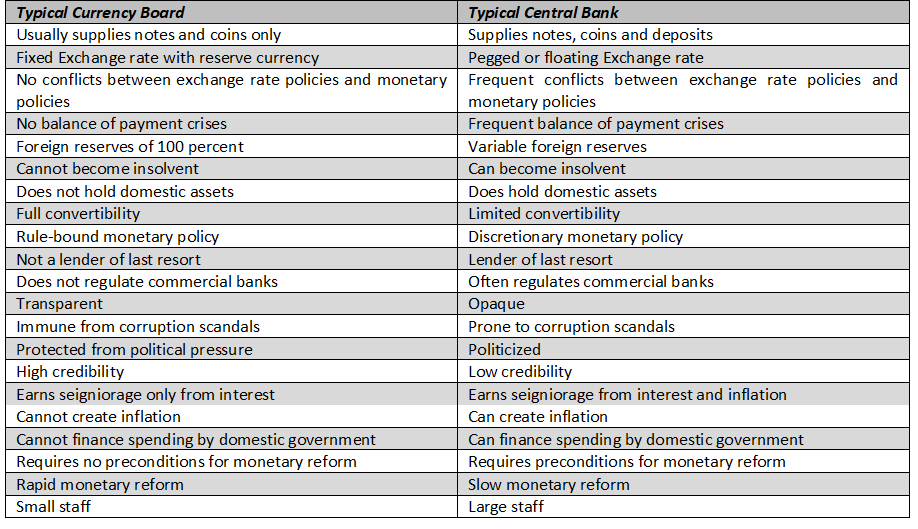

The current central banking system and a currency board alternative are at the core of exchange rate system discussion. The currency board system, which issues notes and coins backed with a minimum of 100 percent of foreign reserves, deserves a fair and accurate evaluation.

For developing countries such as Turkey, which experience frequent balance of payment and currency crises, a currency board system could be a solution for ongoing economic problems, since historical data proves that exchange rate regimes play an important role in these economic crises.

The main differences between a currency board and a central bank are as follows:

A Typical Currency Board versus a Typical Central Bank

|

Source: Hanke (2002),“Currency Boards”, The Annals for the American Academy

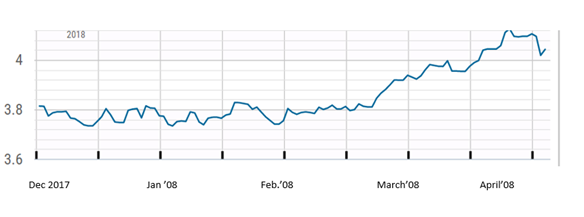

The Turkish Lira has experienced another historic low against the U. S. dollar in April 2018. Turkey’s high inflation and current account deficit, as well as concerns over its general macroeconomic outlook have played a key role in weakening of the Turkish Lira’s value.

The International Monetary Fund (IMF) recently has revised down its forecast for 2019 to 4 percent for Turkish economic growth rate. The IMF also emphasized and warned Turkey about the risks related to exchange rate volatility.

US Dollar / Turkish Lira (2018)

|

This being the case, Turkey’s current economic outlook suggests that the country should adopt an orthodox currency board. If it did this, Turkey could solve its economic problems associated with exchange rate uncertainty. This would probably lead to an increase in the volume of international trade. Additionally, using an anchor currency would increase credibility, which could result in a decrease in the inflation rate and a convergence of the interest rate level to the reserve country’s level. The decrease in interest rates would also lead to an increase in domestic savings and private investments, thus resulting in greater economic growth.

The media, some government officials, and academics have considered a currency board system as a viable alternative for Turkey. However, the discussions on this issue were generally superficial and in the end they tended to favor central banking by focusing on the negative aspects of the currency board system. Thus, an important and well-suited alternative for Turkey has been ruled out, before it could be fairly assessed.

Most importantly, the management of a currency board would eliminate any political pressure aimed at manipulating the currency. This important change would allow Turkey to separate itself from other emerging economies.

|

Dr. Billur Guner Cohen is the Chair of the Business Department at BAU International University and a faculty in the B.A. in Economics program. She is an expert in the fields of international economics, behavioral economics, neuroeconomics, macroeconomics and monetary economics. She completed her Ph.D. in International Economics from Marmara University in Turkey in 2011 and an M.A. also in international economics from Marmara University. She was a postdoctoral fellow at the Institute of Applied Economics, Global Health, and The Study of Business Enterprise at Johns Hopkins University from 2015 to 2016, and a Vice-Chair of the Economics department at Istanbul Kultur University. She has had extensive experience teaching a variety of economics courses over the years, including Introduction to Economics, Microeconomics, Macroeconomics, International Economics, Monetary Theory and Policy, International Trade and Globalization, New Approaches in Economic Theory, Behavioral economics and Neuroeconomics.

The views and opinions expressed in this issue brief are those of the authors and do not necessarily reflect the policy of GPI. |